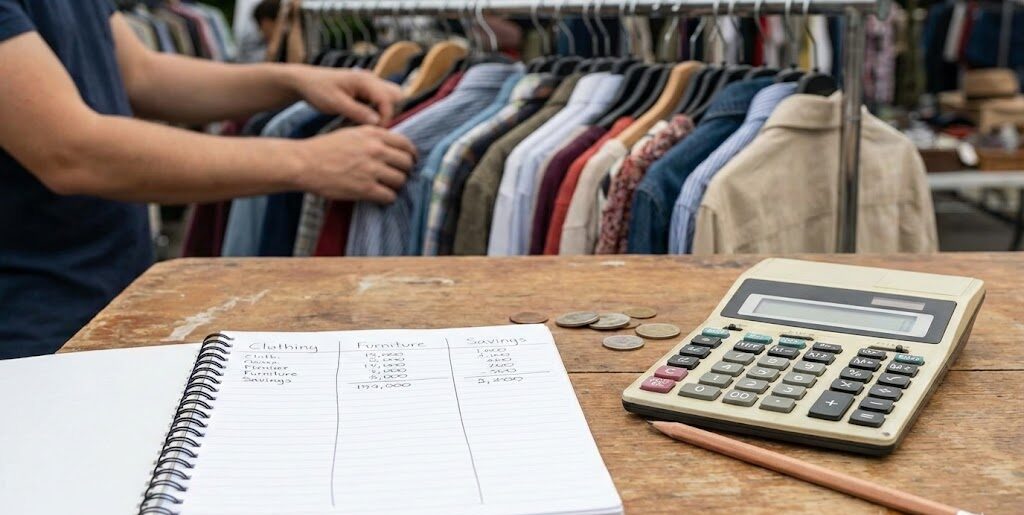

Master Your Thrift Game with a Second-Hand Shopping Budget Planner

Thrifting is more than just a trend; it’s a smart way to build a unique wardrobe, furnish your home, or snag rare books without breaking the bank. But let’s be real: those small purchases at second-hand stores can add up fast if you’re not careful. That’s where a solid budgeting tool comes in handy. A planner designed for thrift shopping helps you set clear limits, prioritize what you’re hunting for, and avoid impulse buys.

Why Budgeting Matters for Second-Hand Finds

When you’re browsing racks of vintage clothing or shelves of pre-loved decor, it’s easy to lose track of spending. Maybe you’ve got $100 for the month, but half of it vanishes on a single retro lamp. By using a tool to allocate funds across categories, you can decide upfront how much goes to each area of interest. Plus, if you’re aiming to save a bit of cash on the side, tracking progress toward that goal keeps you motivated. Stick with a plan, and you’ll enjoy the thrill of the hunt without the guilt of overspending.

FAQs

How does this tool split my budget across categories?

It’s pretty simple! Once you input your monthly budget and pick your categories, the tool divides the amount evenly across them to give you a suggested spending limit for each. If you’ve got a savings goal, set aside a portion for that first, then split the rest. You can always tweak the numbers manually if one category needs more focus—like if you’re hunting for a vintage jacket over books this month.

Can I use this planner if I don’t have a savings goal?

Absolutely, the savings goal is totally optional. If you’re just looking to manage your spending on second-hand goodies, you can skip that part. The tool will still break down your budget by category and show you how much you’ve got left to spend. It’s all about keeping things flexible for whatever your thrifting style is.

What if I overspend in one category?

No worries—overspending happens to the best of us! The tool will show you where you’ve gone over and adjust the remaining funds in other categories so you can see the impact. It’ll also toss in a few practical tips, like checking thrift store sales or swapping items between categories next month to balance things out. Just keep tracking, and you’ll get the hang of it.